A reason for trust

A strict editorial policy that focuses on accuracy, meaning and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publication

A strict editorial policy that focuses on accuracy, meaning and impartiality

The price of a lion football and players are cushioned. Each arcu is to ultra -up all children or hatred for football Ullamcorper.

This article is also available in Spanish.

Ethereum in the last month has faced enormous pressure and sales variability, because the entire cryptographic market of trends down, pushing ETH towards the key level of demand. With uncertainty dominant on the market, traders are careful when Ethereum tries to regain lost land.

Analysts expect even greater variability after the executive ordinance of the US President Trump on Thursday, who established a strategic Bitcoin reserve. Although the advertisement is expected to escalate market moods, it introduced greater uncertainty, leaving investors uncertain of its long -term influence on cryptocurrency space.

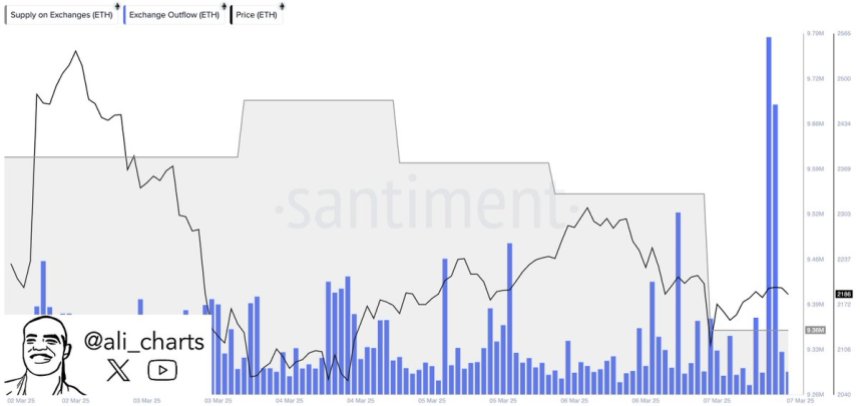

Despite the continuous decline, the data on the Santiment chain reveal the stubborn signal-330,000 Ethereum has been withdrawn from the exchange in the last 72 hours. Such enormous outflows often indicate investors transferring ETH to private portfolios, which suggests reduced sales pressure and possible long -term accumulation.

Because Ethereum rises at key levels of support, the coming days will be crucial when determining whether ETH stabilizes or opposite the further minus. If the market moods improve and the exchanges of the outflow are continued, Ethereum may observe a powerful revival. However, if pressure for sale is maintained, another leg remains possible by keeping traders on high ambulance.

Ethereum faces a critical test

Ethereum has lost over 50% of its value since the end of December, causing great fear and panic on the market. Once the leading strength in cryptographic rallies, ETH is now trying to regain the momentum, leaving investors asking if the long -awaited Altsason season materializes this year. Many analysts speculate that it will not be, because Ethereum and most Altcoins are still fighting, unable to recover stubborn settings or establish a clear recovery trend.

Despite the bears of sentiment, there is still hope for reflection, because the data on the chain suggests potential stubborn catalysts. Ali Martinez was shared by Santiment Data, revealing that 330,000 Ethereum has been withdrawn from the exchange in the last 72 hours. This significant outflow may indicate that investors transfer ETH to private portfolios, reducing immediate pressure on sale and potentially establishing a stage to squeeze supplies.

Specifying the supply occurs when the available asset supply on the stock exchanges decreases, which makes it complex for sellers to reduce prices. If Ethereum still maintains key demand zones and an escalate in pressure on purchase, the reduced exchange supply can lead to powerful recovery towards higher price levels.

For now, traders are watching whether ETH can stabilize and regain critical levels of resistance. If the bulls regains the momentum, Ethereum can start the recovery trend in the coming weeks. However, if the sales pressure is maintained, the next wave of down the down remains possible by keeping the market on the edge. The next few days will be crucial for determining the compact -term direction of Ethereum and whether the last withdrawal of the exchange signal the turning point for ETH.