This article is also available in Spanish.

Ethereum has faced significant volatility over the past few days, with massive selling pressure emerging after the cryptocurrency failed to break above yearly highs set earlier in December. This price action has traders and investors questioning ETH’s next course of action amid its consolidation under critical resistance.

Despite the turmoil, supply chain data suggests a potentially upside outlook. Analyst Ali Martinez shared insightful data showing that Ethereum whales are accumulating heavily during this period of uncertainty. According to the data, whales purchased 340,000 ETH worth over $1 billion in the last 96 hours. This significant accumulation indicates that major players see Ethereum’s long-term value, even if short-term market sentiment remains mixed.

The ongoing whale activity could signal an upcoming ETH recovery, with enormous holders positioning themselves for future gains. Historically, such phases of accumulation often preceded sturdy rallies as increased demand and decreased supply contributed to upward momentum.

The demand for Ethereum whales continues to grow

Ethereum demand has shown significant volatility throughout the year, with persistent selling pressure pushing prices down from local highs. Each rally attempt has met resistance, highlighting the challenges ETH has faced in maintaining its upward momentum. Despite this, Ethereum continues to show resilience, especially during recovery phases when enormous holders actively accumulate ETH.

Most recently, Martinez shared compelling data on Xindicating an unusual trend of whale accumulation. In the last 96 hours alone, whales have purchased 340,000 Ethereum worth over $1 billion. This significant purchasing activity highlights the confidence that major players have in Ethereum’s long-term potential. Such accumulation often signals the possibility of a market turnaround, with whales strategically positioning themselves ahead of a potential breakout.

Martinez and other analysts believe whale-fueled demand points to significant price increases in the coming weeks. Moreover, the broader cryptocurrency community anticipates that Ethereum will play a key role in next year’s anticipated alt season, cementing its position as a market leader among altcoins.

As Ethereum enters this critical phase, market participants will closely monitor its ability to benefit from ongoing accumulation. If whale activity continues, it could pave the way for Ethereum to regain local highs and potentially set up-to-date milestones, strengthening its dominance in the crypto space.

Key support from ETH Holding

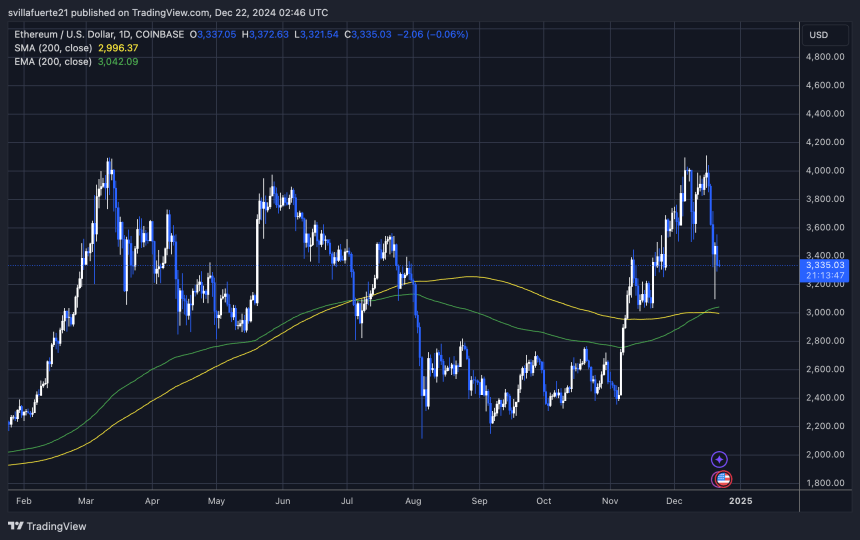

Ethereum is currently trading at $3,320, showing resilience after holding above the critical 200-day moving average (MA) at $3,000. This level is widely considered a key indicator of long-term market strength. Holding above this value suggests that Ethereum remains in a bullish pattern despite recent volatility and selling pressure.

For Ethereum to regain momentum, bulls will need to push the price above the $3,550 resistance level and hold it. A breakout of this zone would signal a renewed uptrend and enhance the likelihood of Ethereum testing higher levels. However, this cannot happen immediately, as the market may enter a period of sideways consolidation.

Such consolidation is common after periods of increased volatility and allows the market to create a more stable base for the next significant move. A sturdy consolidation phase above $3,000 would further confirm the 200-day MA as a solid support level, increasing confidence among investors.

Featured image from Dall-E, chart from TradingView