Rekt Capital Cryptocurrency Analyst provided some form of optimism for Bitcoin investors, suggesting that the massive selling pressure on the flagship cryptocurrency is almost over. This comes amid a significant enhance Bitcoin Dominance.

Bitcoin Seller Exhaustion Has Reached Its Peak

WX (formerly Twitter) fastingRekt Capital mentioned that ” volume on the sell side reached and even dramatically exceeded the level of seller exhaustion seen in previous upward price reversals.” The analyst added that Bitcoin has not seen this level of selling volume since Halving event in April this year.

This undoubtedly represents a bullish development for the flagship cryptocurrency, as Bitcoin is sure to witness a massive reversal now that the selling pressure has almost ended. This is already happening, as Bitcoin has rebounded in the past 24 hours after falling under $50,000 for the first time since January.

So Rekt Capital he suggested that Bitcoin could rebound to $62,550 in the tiny term as it looks set to fill the gap CME gapwhich currently ranges from $59,400 to $62,550. He noted that the chances of Bitcoin filling this gap are high as the cryptotoken has filled all the gaps CME has created over the past few months.

Cryptocurrency analyst Skew also he commented on the massive selling volume that Bitcoin has recently experienced. He explained that this is because Bitcoin has failed to stay above $70,000 following the July price bounce. The analyst added that “there is no real chaos yet,” suggesting that there is no reason to worry about the latest price correction.

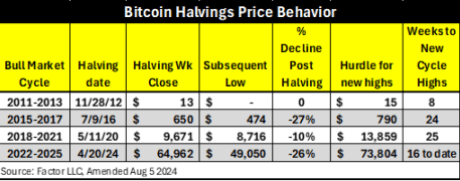

As seller exhaustion has peaked, there is also a possibility that Bitcoin has found a bottom and that this could be the last correction before the full momentum of the bull market. Experienced Trader and Analyst Piotr Brandt noted that Bitcoin’s decline in value since the halving means it has now reached a price decline similar to what it experienced during the halving bull market cycle of 2015–2017.

BTC Dominance Hits 3-Year High

Amidst the market turmoil, data from Coinglass shows that Bitcoin Dominance recently reached its highest level since April 2021. The enhance was largely due to Spot Bitcoin ETF, which brought novel money into the Bitcoin ecosystem. Meanwhile, altcoins had to fight for capital from existing retail investors who still get rid of your money between several crypto assets.

Cryptocurrency analysts like Roman have suggested that Bitcoin’s dominance will likely continue to grow as Planned that the flagship cryptocurrency will continue to absorb all liquidity until the end of this year. It is expected that Ethereum and other altcoins continue trading sideways during this period.

At the time of writing, Bitcoin is trading at around $56,000, up more than 10% in the past 24 hours, according to data data from CoinMarketCap.

Featured image from Cointribune, chart from Tradingview.com