Bitcoin (BTC) is currently trading below the key $60,000 level, with the market gripped by significant uncertainty and volatility. Traders are closely watching for signs of a potential breakout as BTC remains near this critical threshold.

Despite the concerns, key data from CryptoQuant suggests that BTC could be on the verge of a significant bull run. A historically exact indicator has emerged that points to an upcoming Bitcoin price rally. As the market moves through this turbulent period, this data could be the signal that investors have been waiting for, suggesting a possible change in momentum and a return to bullish territory.

Up-to-date Stablecoin High Suggests Possible Bitcoin Breakout

CryptoQuant Data reveals that the total market capitalization of stablecoins has reached a record high of $165 billion, an all-time high. This escalate in stablecoin market capitalization is particularly significant because it often precedes the price increases for Bitcoin and altcoins.

When the market capitalization of stablecoins starts to rise, it typically signals an influx of liquidity into the cryptocurrency market, setting the stage for a potential upside scenario.

This metric becomes especially essential when the market capitalization of stablecoins consolidates, as it has done over the past few months, and then begins to rise.

Such growth has historically been a precursor to bullish moves for Bitcoin and other cryptocurrencies. A similar pattern occurred between September and November of last year, when the stablecoin market capitalization consolidated at around $120 billion. As it began to breakout, Bitcoin prices followed suit, leading to a significant uptrend in the cryptocurrency market.

Given the current record market cap for stablecoins, we could be on the verge of another significant uptrend. The rising market cap suggests that more capital is poised to flow into the broader cryptocurrency ecosystem, potentially driving prices higher in the coming weeks.

BTC consolidation ahead of uptrend

Since March, when the price of Bitcoin reached its all-time high, there have been four significant corrections followed by post-halving consolidation.

Currently trading at $59,605 below the critical $60,000 level at the time of writing, Bitcoin needs to reclaim and secure this price point before any significant move up occurs. The $60,000 level serves as a psychological and technical threshold for reigniting bullish momentum.

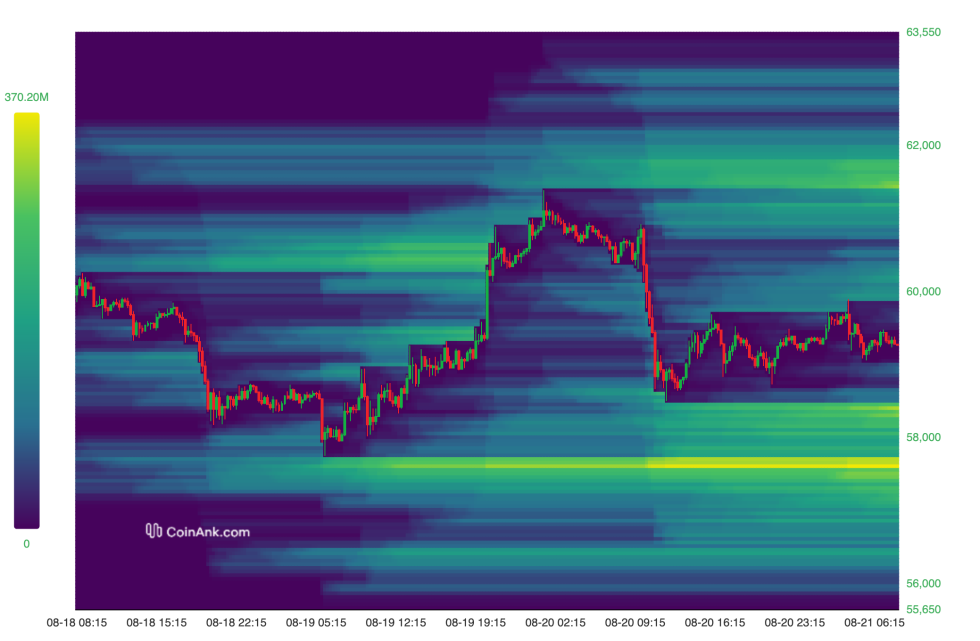

However, there is scope for further declines, with a potential retest of liquidity below $57,500. According to CoinAnk Liquidation Heat MapThere are significant levels of leveraged liquidity just below this price, indicating that a pullback could trigger significant liquidations and further price declines.

Amidst this uncertainty, the recent escalate in stablecoin market cap could be a promising sign. A rising market cap after consolidation often signals increased liquidity in the cryptocurrency ecosystem, setting the stage for a bull run.

As stablecoins reach recent all-time highs, it could be a sign that a period of uncertainty and fear is coming to an end, providing the confidence needed to resume Bitcoin’s upward trajectory.

Cover image from Dall-E, charts from Tradingview