This article is also available in Spanish.

Chainlink (LINK) is at a key level after a edged 22% rebound from recent local highs, which has raised concerns among investors and analysts. The latest decline is compounded by troubling on-chain data that suggests Chainlink’s network activity may be weakening, adding to the uncertainty surrounding the asset. This drop in activity, combined with broader market volatility, has raised concerns about further losses.

If the current bearish sentiment continues, LINK is likely to test the next significant demand level around the $9 bottom. This level is critical in determining the near-term future of the asset. A break below could signal deeper declines, while a successful defense could set the stage for a recovery.

Investors are closely monitoring developments as the coming days will be crucial for the direction of Chainlink stock prices and overall market sentiment.

Chainlink powered by low network activity

Chainlink (LINK) has been facing significant selling pressure recently, fueled by more than just market speculation. Degenerating network activity is also playing a key role in the ongoing downtrend.

According to the key data from SantimentThe discrepancy between price and Daily Busy Addresses (DAA) is currently -56.35%. This negative discrepancy indicates a disconnect between Chainlink’s price and user engagement, which could be a sign of potential problems.

The DAA metric is key to understanding whether network activity is supporting price movements. Generally, when lively addresses, which measure users’ stake in the blockchain, are rising along with the price, it indicates robust underlying demand. This can suggest that the cryptocurrency is poised for higher values. On the other hand, if network activity is rising while the price is falling, it often represents a buying opportunity, signaling that the market may soon turn around.

However, the current drop in DAA for Chainlink paints a less bullish picture. This drop indicates that user engagement is not supporting recent price action, which is usually a bearish factor. An enhance in network activity is necessary for LINK to see any significant consolidation and potential rebound.

Without a corresponding enhance in DAA, the cryptocurrency may have a demanding time breaking out of its current downtrend. Investors are closely watching this metric as the continued decline in network activity could lead to further downward pressure on Chainlink’s price, potentially pushing it towards lower support levels.

9 dollar lifeline LINK

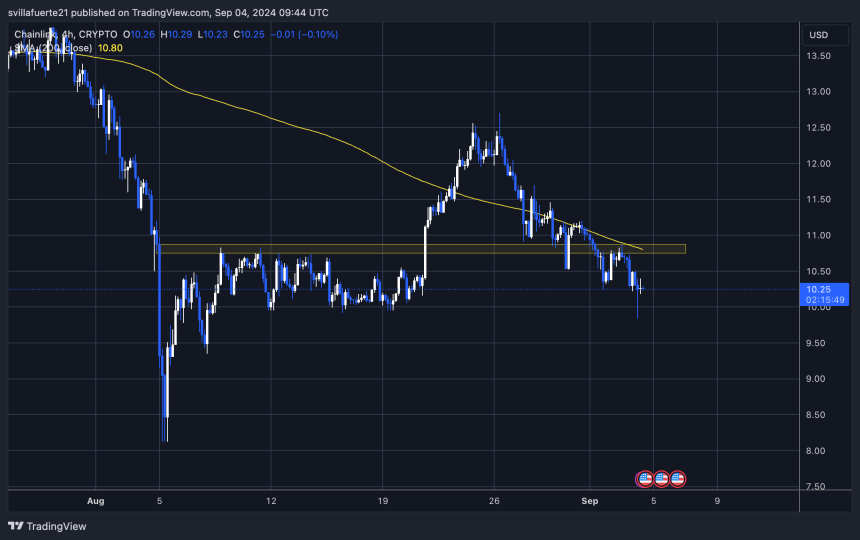

Chainlink (LINK) is currently trading at $10.24, after falling below its August 16 low of $9.92. LINK quickly rebounded after briefly touching $9.84, signaling demand at that level. However, despite this rebound, LINK remains below the 4-hour 200-minute moving average (MA), a critical technical indicator, which currently stands at $10.80.

Analysts view this MA as a key level and a successful move above it could indicate a change in momentum, potentially pushing LINK towards the next resistance at around $11.50.

Conversely, if LINK fails to maintain its current position and falls further, a deeper correction could drag the price below $9. This would indicate further bearish pressure, and traders and investors are watching the price closely. LINK’s ability to reclaim the 200 MA or break below recent lows will be key in determining its next significant move.

Featured image is from Dall-E, chart is from TradingView