This article is also available in Spanish.

Cryptocurrency analyst TradingShot previously predicted that the price of Bitcoin could rise to as much as $150,000 in this bull market. With the flagship cryptocurrency now close to the $100,000 milestone, the analyst charted Bitcoin’s current price action and provided insight into how the cryptocurrency could reach the $150,000 goal by 2025.

Bitcoin’s current price action and path to $150,000

In TradeView entryTradingShot found that Bitcoin’s price is currently trading outside the Fibonacci range of 0.786 to 1.0, where it has consolidated from March 2024 to October 2024. The analyst noted that the October breakout was largely driven by the US presidential election and the euphoria following them Donald Trump won.

TradingShot said that Bitcoin’s price has been just a month outside this range and is already much higher. He noted that last month’s candle was similar to those in November 2020 and May 2017. Coincidentally, it was during these periods that “the most aggressive rallies these bull cycles have begun.”

Crypto said Bitcoin’s price traded at a 71.5° angle between May and December 2017. In the 2021 cycle, Bitcoin traded at a 68.5° angle (3° lower) between November 2020 and April 2021. If proven turns out to be a trend TradingShot noted that it is unthreatening to assume that a parabolic escalate in 2024/2025 can run at an angle of 65.5° (-3° compared to the previous cycle).

In line with this, TradingShot stated that this gives Bitcoin’s price a potential target of $300,000 as early as May 2025 if the cryptocurrency experiences a double top cycle like in 2021. Meanwhile, the cryptocurrency analyst assured that Goal $150,000 is “very likely” from a technical analysis perspective because it is just below the high of the multi-year channel highlighted on the chart.

BTC’s next move still unclear

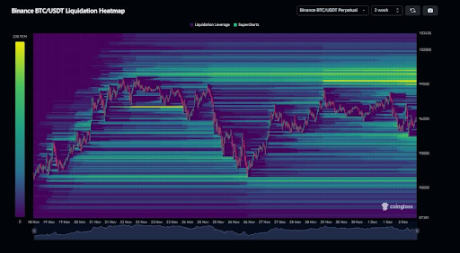

Amid this bullish Bitcoin price prediction, a cryptocurrency analyst Kevin Capital suggested that BTC movement is still unclear. He stated that while Bitcoin has a lot of downside liquidity of around $88,000, the actual majority of liquidity is still in the $100,000 to $103,000 range. Based on this, the analyst concluded that it was best to sit back and watch what happens next.

Meanwhile, cryptocurrency analyst Mikybull Crypto suggested that Bitcoin’s price may undergo a cooling period in the meantime. This came after he revealed that a sell signal had flashed for the first time since 2020 amid Bitcoin’s dominance. Therefore, he said it was official altcoin season.

Blockchain Center data shows that altcoin season has indeed arrived. Over the last 90 days, 75% of the top 50 coins by market capitalization have outperformed Bitcoin’s price. Since it’s altcoin season, Bitcoin may frosty down while altcoins see parabolic gains.

At the time of writing, Bitcoin is trading at around $95,600, down over the last 24 hours, according to data from CoinMarketCap.

Featured image created with Dall.E, chart from Tradingview.com