A reason for trust

A strict editorial policy that focuses on accuracy, meaning and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publication

A strict editorial policy that focuses on accuracy, meaning and impartiality

The price of a lion football and players are gentle. Each arcu is to ultra -up all children or hatred for football Ullamcorper.

This article is also available in Spanish.

The price of bitcoins increased to USD 80,000 after a pointed decline caused by the fears of US President Donald Trump’s tariff policy. The cryptocurrency market has noted panic sales in the last 12 hours, when economic concerns have spread in different sectors.

The market captain is USD 1.5 trillion when the dominance of bitcoins is growing

According to Bitcoin’s market data market capitalization Currently amounts to USD 1.5 trillion despite recent price fluctuations. While the leading cryptocurrency has slightly returned, Altcoins are still fighting deeper losses.

The domination of Bitcoin on the general cryptographic market increased to 60%, showing that investors can seek shelter in the largest digital assets in uncertain times.

Market analysts on the market The market reacts directly to broader economic fears, not specific-consigning problems.

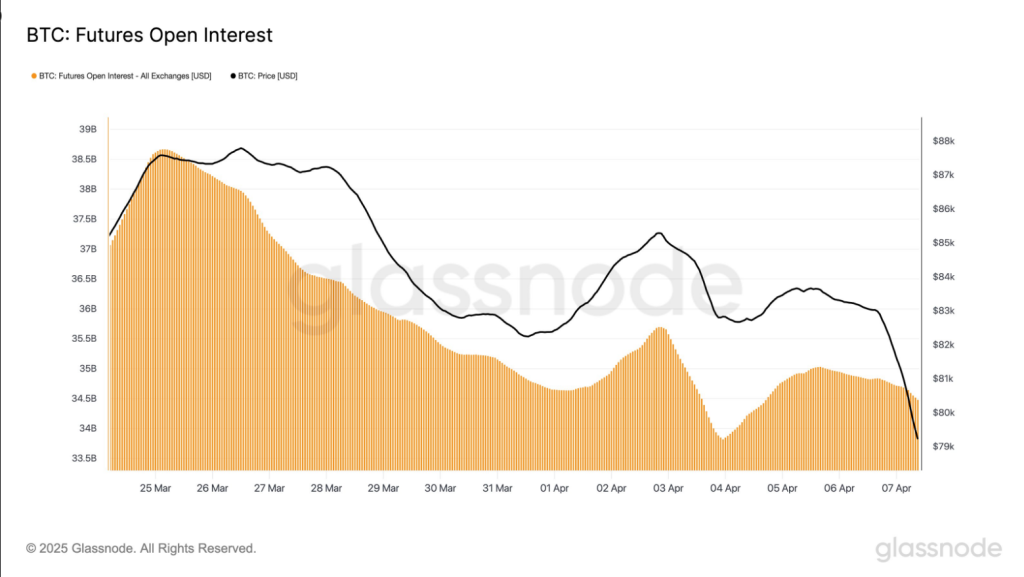

$ Btc Open interest rates are $ 34.5 billion. While on April 3 there was a brief recovery from the lowest level of USD 33.8 billion, a wider decrease remains intact. The exposure to the Futures is still developing because traders reduce the risk in response to the decrease in price of price. pic.twitter.com/zx06yoctsa

– Glass node (@Glassnode) April 7, 2025

The Futures market shows surprising immunity

Based on reports from Glassnode, the open interest of Bitcoin Futures fell to $ 34.5 billion, showing tiny recovery from the lowest level of $ 33.8 billion in April, but maintaining a general downward trend. Traders reduce the Futures exhibition when Bitcoin’s price shoots have slowed down.

From March 25, interest in cash dropped from $ 30 billion to $ 27 billion. Open cryptocurrency interest fell at the same time from USD 7.5 billion to USD 6.9 billion. Newer data indicate that the open cryptocurrency interest began to grow again, which indicates that some traders return to more risky positions.

Participation in cryptographic contracts of Futures contracts reached 21% of open interest on 19% on April 5. This change can make the market make the market more reacted to price change, and therefore lead to increased variability in the next few days.

Confined liquidation suggests controlled sales

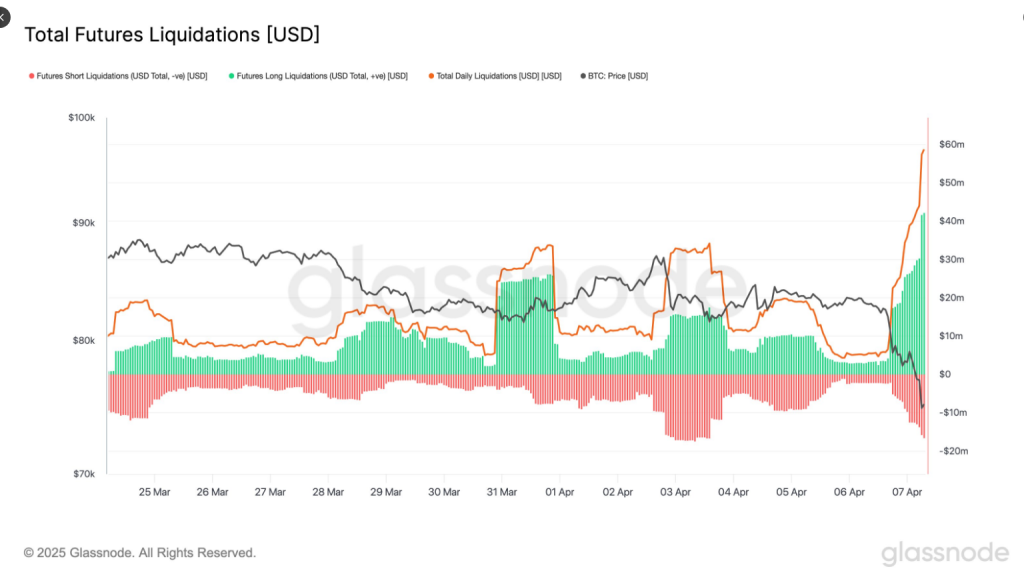

The last 24 hours witnessed the liquidation of the Bitcoin value of $ 58 million, and Longs took $ 42 million compared to tiny shorts. Market observers indicate that this number of liquidation is extremely low, taking into account the decrease in the price of 10% Bitcoin.

Total $ Btc Futures liquidation has reached USD 58.8 million in the last 24 hours. Longs took a heavier hit with USD 42.1 million erased compared to USD 16.6 million. Despite the price drop by 10%, this liquidation size is relatively tiny, which suggests restricted mountain racing lever. pic.twitter.com/104km2xqof

– Glass node (@Glassnode) April 7, 2025

Relatively tiny numbers of liquidation indicate that the market was not highly used before selling. Long liquidations accounted for about 73% of the total Futures liquidation, which indicates a gently stubborn fondness before correction.

These numbers are pale compared to previous market events in February and March, when daily liquidations exceeded $ 140 million. The current trend indicates a structured price drop driven primarily by point sale, not a wave of forced liquidation due to excessive positions.

Institutional investors are still entering the market

There are reports of increased institutional demand despite the recent market variability. Statistics reveal that 76 up-to-date institutions with over 1000 BTC have entered the network in the last two months, which is an augment of 4.5% in gigantic Bitcoin owners.

A distinguished picture from Gemini Imagen, chart from TradingView