The data shows that bitcoin market sentiment has once again turned extremely worrying, with the asset’s price falling to $59,000.

Bitcoin’s Fear and Greed Index Suggests the Market Is Extremely Fearful Right Now

The “Fear and Greed Index” is an indicator created by Alternative that tells us about the average sentiment currently prevailing in the Bitcoin and broader cryptocurrency markets.

The index uses the following five factors to determine sentiment: volatility, trading volume, social media sentiment, market capitalization dominance, and Google Trends. It then presents this assessment using a scale of 0 to 100

Any indicator values above 53 indicate that investors are exhibiting greed, while those below 47 suggest the presence of fear in the market. The area between these two cut-off points naturally corresponds to a neutral mentality.

In addition to these three territories, there are also two specific moods called extreme fear and extreme greed. The former occurs at ages 25 and under, and the latter at ages 75 and over.

Here is what the latest value of Bitcoin’s fear and greed index looks like:

As you can see above, the indicator currently has a value of 25, which means the market is right in the extreme fear zone. This is a pretty significant change compared to how the indicator looked yesterday.

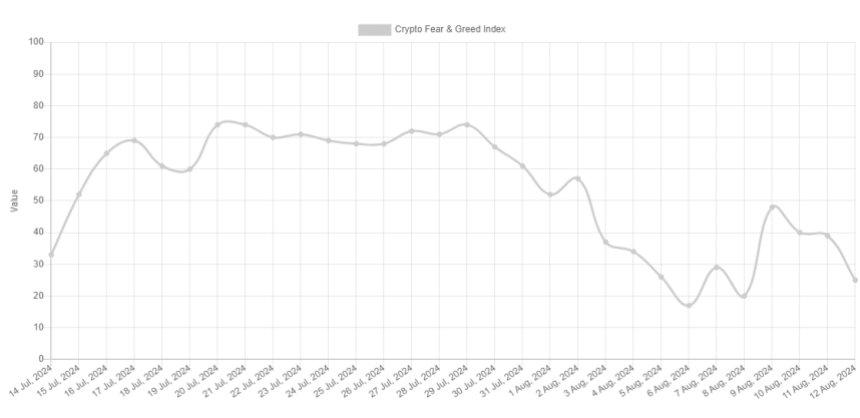

The chart below shows the trend of the Bitcoin Fear and Greed Index over the past month.

The chart shows that the fear and greed indicator was at a high level at the end of July, but due to the bearish trend that occurred in the BTC price, the value of this indicator also dropped significantly.

On the 29th, the index was at 74, which meant it was on the verge of extreme greed, but on the 6th of that month, it crossed the extreme fear zone, reaching a value of 17.

The recent rebound in the asset has indeed led to an improvement in sentiment, with the index returning to the 48 level. However, it looks like this rally could not last long as sentiment has once again dipped to extreme fear as the BTC price has seen a correction.

The fact that sentiment has soured may not be a bad sign for the cryptocurrency, though. Historically, Bitcoin has tended to move against most expectations, and the extreme regions are where those expectations are likely to be the strongest.

As such, peaks and troughs tended to form when the market was in these zones. As the fear and greed index has returned to extreme fear, it is possible that a bottom could be in place. It now remains to be seen whether the asset’s decline will end with this decline or if there will be more.

BTC price

Bitcoin appears to be showing signs of a rebound already, with its price rising to $59,700 from a low of just under $58,000 reached earlier in the day.

Featured image from Dall-E, Alternative.me, chart from TradingView.com