A reason for trust

A strict editorial policy that focuses on accuracy, meaning and impartiality

Created by industry experts and meticulously reviewed

The highest standards in reports and publication

A strict editorial policy that focuses on accuracy, meaning and impartiality

The price of a lion football and players are supple. Each arcu is to ultra -up all children or hatred for football Ullamcorper.

Tom Lee, head of research, Fundstrat, says Bitcoin It can be increased to $ 250,000 until the end of 2025. According to the interview at Squawk Box CNBC, Lee pointed out that Bitcoin recently fell from the highest level of all time by $ 111,970 to around USD 104,000. He still thinks that the market is persistent at this level.

Low -term Lee perspectives

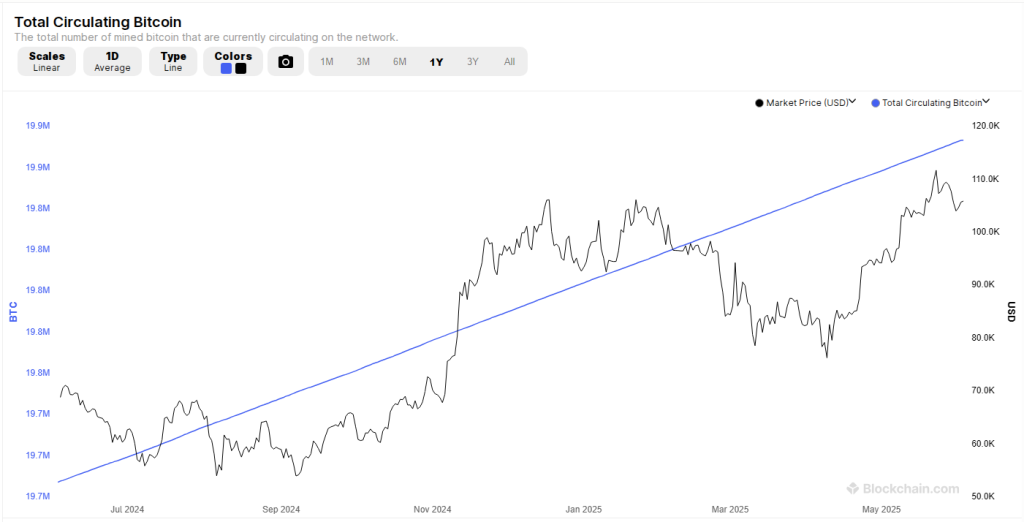

Lee said that the host Squawk Box Joe Kernen, that 95% of all Bitcoins – about 19.80 million coins – have already been extracted from a maximum of 21 million. This leaves about 1.13 million coins waiting to produce. Sees it as tight Supply configuration.

He also noted that although almost all bitcoins exist, 95% of the global population has no one. On the basis of reports that the difference between pads and potential buyers can raise prices in the coming months.

To reach USD 250,000 from around USD 104,000, Bitcoin would have to jump by about 140%. Lee still thinks that he can reach $ 150,000 by December, and can even extend to $ 200,000 to $ 250,000 if the demand for heats.

Gap of supply and demand

Lee emphasized the fact that most people in the world have not bought any bitcoins. He said it causes an imbalance. On the one hand, you have almost set delivery. On the other hand, there may be millions of up-to-date buyers over the next 10 years. He explained that even if a fraction of these people decides to buy Bitcoin, the price may raise significantly.

https://www.youtube.com/watch?v=TK-7s_muixu

At the moment, only about 5% of all coins remain to be mined. This means that up-to-date deliveries slowly sluggish down. At the same time, more wallets, applications and effortless purchase methods can bring up-to-date money. Lee thinks that this mismatch is a enormous part of why Bitcoin can climb.

Long -term valuation goals

When asked about the terminal value of Bitcoin – which means its price when all coins are mined at 2140 – Lee said that he expected that he would match the market capitalization of Gold with a value of about $ 23 trillion. It works at least $ 1.15 million on bitcoin, if there are 20 million coins in circulation.

He chose 20 million instead of 21 million, because he accepted losses (lost keys, forgotten wallets) mean that not every coin will never be released. Lee went on, saying that he saw a place for Bitcoin, which reached $ 2 million or $ 3 million per coin. This would cause its average “bull” to $ 2.5 million, which is about 2,300% growth compared to today’s levels.

Other analysts projections

Matthew Sigel, head of research on the digital assets of Vanecka, also has a long range forecast. Based on what Sigel told investors, Vaneck sees Bitcoin reaching $ 3 million by 2050. This forecast is consistent with Lee’s idea about Bitcoins’ matching, and even with the time of overcoming gold. Both connections assume a constant raise in demand, as well as the wider exploit of enormous institutions, such as hedge funds or pension plans.

A distinguished painting from Gemini, chart from TradingView