Cryptocurrency analyst TradinSides revealed that the recent XRP crash to $2 may have ended the second bear wave. With this in mind, the cryptocurrency analyst mentioned factors that could cause wave 3 to move impulsively upwards.

XRP price collapse ends second bear wave

In TradeView entryTradingSides stated that a retest of the XRP price at $2 could mark the end of the second Elliot wave of the bullish XRP cycle. Since Wave 2 has likely already ended, an impulsive upward move in Wave 3 will occur at any time. The cryptocurrency analyst presented five factors on which this bullish potential is based.

First, the analyst cited the recent launch RLUSD by Ripple as one of the factors that may influence the movement of Wave 3 towards the XRP price. The launch of the stablecoin has undoubtedly provided a bullish outlook for XRP, especially considering its price surge following the launch of RLUSD on December 17.

Another factor mentioned by the cryptocurrency analyst is Donald Trump’s adoption of altcoins. The US president-elect has already declared his pro-crypto stance and is expected to create a regulatory-friendly environment for these altcoins at some point takes office January 20. The price of XRP may raise significantly due to this event, as Ripple was one of the main cryptocurrency donors to Donald Trump’s campaign and his upcoming inauguration.

XRP market cap currently at $128 billion. Chart: TradingView.com

TradinSides also cited the appointment of pro-crypto Paul Atkins as another factor ensuring bullish price potential for XRP. The Atkin administration is expected to end the Commission’s regulation-by-enforcement approach to the cryptocurrency industry.

This may cause the SEC to withdraw its appeal against Ripple, which is another factor that the cryptocurrency analyst mentioned that could provide a significant raise in the price of XRP. Finally, the analyst presented the approval of XRP ETFs as a factor that could trigger a third wave of XRP growth.

Higher time frame analysis

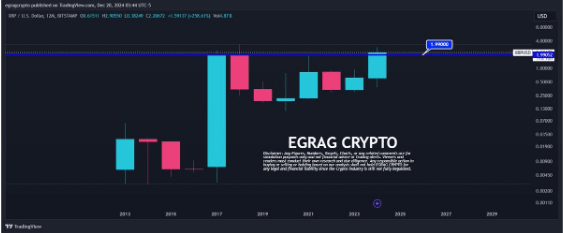

In the post: X, cryptocurrency analyst Egra Crypto presented an in-depth analysis of XRP prices based on higher time frames. In the case of the one-year candle, the analyst noted that a close above $1.99 would be a game changer. He added that the $1.99 target represents a 2017 candle body close, and a close above that level would be a historic moment for XRP.

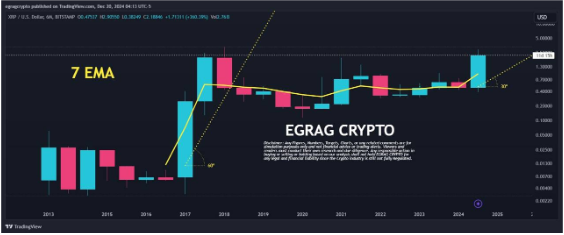

Analyzing the six-month chart, Egrag Crypto found that the XRP price is currently more stable, with lower risk and steadier growth than in the 2017 cycle. It predicts that XRP will see a more sustainable price raise this time around.

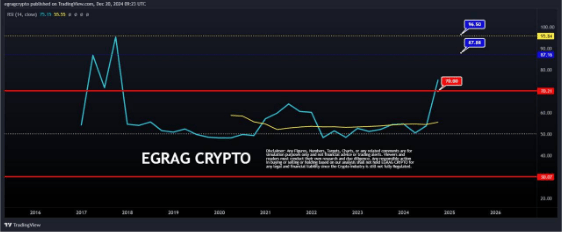

In its 3-month chart analysis, Egrag Crypto found that Relative Strength Index (RSI) it still has plenty of room to grow in that time frame. He added that the price of XRP has already crossed the 70 mark, which is an “extremely bullish” value, and that the cryptocurrency still has two more bullish targets at 87 and 96.

Finally, with a 2-month horizon, the cryptocurrency analyst concluded that the XRP price is above equilibrium. The last time something like this happened, the price of XRP saw a massive 13x price raise. As such, the analyst noted that a rally to $13 seems “super easy” to achieve.

Finally, with a 2-month horizon, the cryptocurrency analyst concluded that the XRP price is above equilibrium. The last time something like this happened, the price of XRP saw a massive 13x price raise. As such, the analyst noted that a rally to $13 seems “super easy” to achieve.

At the time of writing, XRP is trading around $2.36, up over 4% in the last 24 hours, according to data from CoinMarketCap.

Featured image from The Giving Block, chart from TradingView