In his latest analysis, legendary trader John Bollinger expressed concerns about Litecoin’s performance, especially compared to Bitcoin. Bollinger, known for developing the popular Bollinger Bands technical analysis tool, has drawn attention to a disturbing pattern in the Litecoin market.

He he noticed“I was asked to analyze LTCBTC. What worries me most is its poorer performance compared to Bitcoin. From a price perspective, the controlling feature of LTCUSD is the 2-bar reversal in the lower Bollinger Band, which is usually considered a bearish signal by traders.

Litecoin Bollinger Bearish Prediction Explained

The LTC/USD pair chart provided by Bollinger on November 28, 2023 shows Litecoin’s price action in relation to Bollinger Bands on both a daily and weekly scale. The price is currently hovering around $69,566, well below the upper Bollinger Band, suggesting a lack of bullish momentum.

Bands are created by plotting a range of standard deviations above and below a uncomplicated moving average, usually covering price action. In this chart, the daily and weekly candlestick chart shows that the LTC/USD price is struggling below the middle of these bands, which is a bearish sign. The price currently near $69.566 is well below the upper band level of around $90, representing a potential resistance level.

Bollinger Bands (BB) on the chart are determined by a 20-period moving average with a standard deviation range of 2. Bollinger analysis indicates a “2-bar reversal” pattern in the lower band. This pattern appears when a bar makes a high above the previous bar, but then closes below the close of the same previous bar, indicating a possible uptrend reversal. This formation occurred near the lower band, indicating that any attempt to push the price upwards is met with resistance and selling pressure prevails.

The Bollinger %B indicator is also key here because it compares the price of Litecoin to the range defined by the Bollinger Bands. A %B value below 0.5 indicates that Litecoin’s price is closer to the lower band than the upper band, potentially signaling weakness. The chart shows that the indicator does not break above the 0.5 level after falling towards 0, which means that the price often touches or falls below the lower band.

LTC price under pressure

Bollinger Band Width (BBW) serves as another indicator to measure volatility by assessing the width of Bollinger Bands. A narrowing of the bands, as seen in the second part of the chart, suggests a decline in volatility and often precedes significant price movement. In this context, the narrowing of BBW on the Litecoin chart may indicate that the market is tight and possibly preparing for an impending breakout or crash.

When Bollinger mentions Litecoin’s underperformance compared to Bitcoin, it is vital to note that Bitcoin often leads the trend in the cryptocurrency market. If Litecoin is not keeping up with Bitcoin’s movements, it may suggest a lack of trust or interest on the part of traders in altcoins (as demonstrated by Bitcoin’s current rise in dominance) and Litecoin specifically.

To summarize, Bollinger technical analysis indicates that Litecoin is in a precarious situation. Price action in the lower Bollinger Band, a bearish “2-bar reversal” pattern, Bollinger B values below 0.5, and a narrowing BBW suggest that Litecoin may continue to experience downward pressure in the near future.

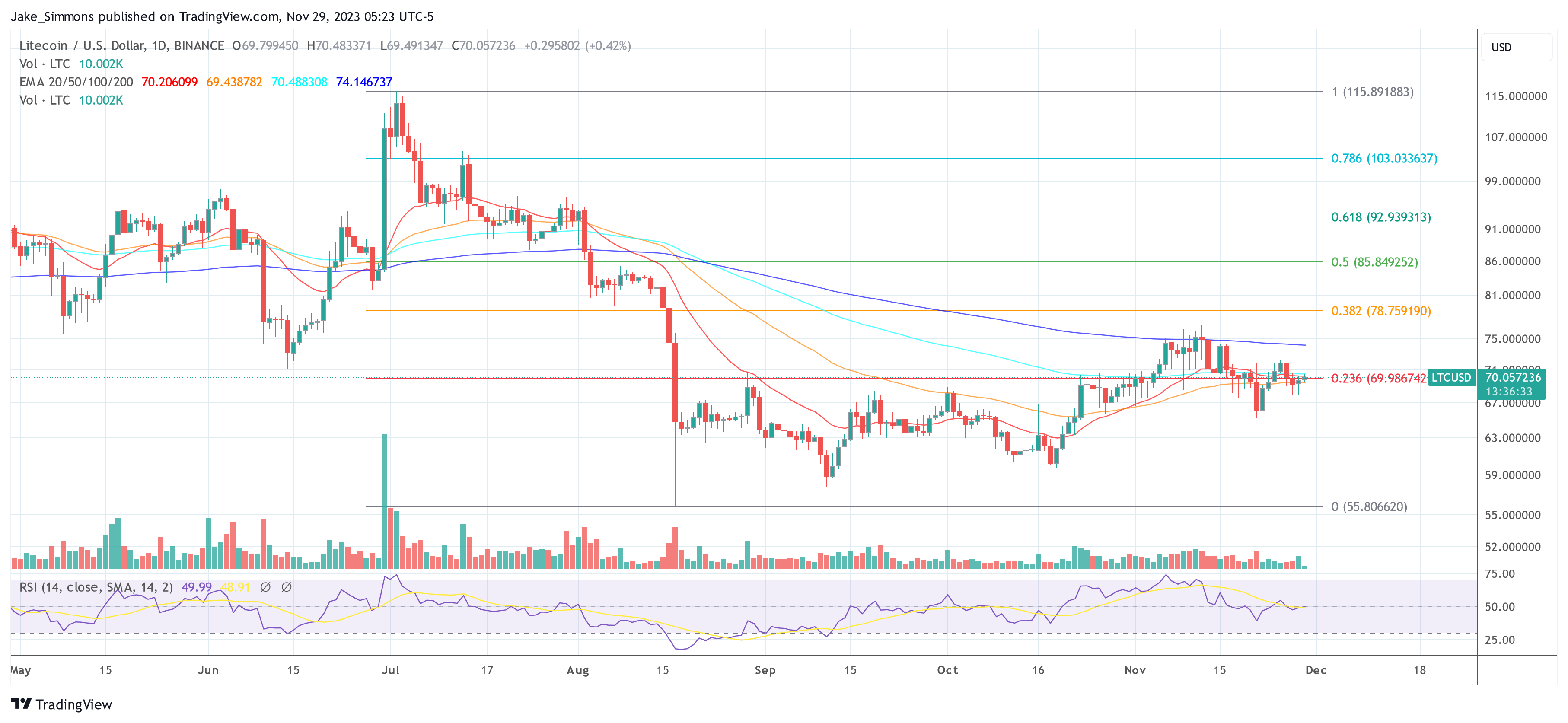

At the time of publication, Litecoin was trading at $70.05. The LTC/USD one-day chart shows that two days ago, the altcoin dropped below key support at the 0.236 Fibonacci retracement level at $69.98. A retest is currently taking place, a daily close above this level has a huge impact on the price of Litecoin.

Featured image from Unsplash / Kanchanara, chart from TradingView.com