Recent trading patterns have led QCP Capital, a well-known trading firm, to attraction potential signs of a bottom in the cryptocurrency market. Bitcoin, the leading digital currency, recently fell below $58,000, causing analysts to focus on the behavior of miners and their possible capitulation.

Such a capitulation could indicate a market bottom, similar to previous market cycles. In 2022, a parallel decline in hashrate sent bitcoin prices plummeting to $17,000, suggesting a recurring theme that could signal an upcoming rebound.

Has Bitcoin bottomed?

Bitcoin’s decline from the critical support level of $60,000 to the current low of just under $58,000 (at the time of writing) has sparked debate among QCP analysts.

In their latest Telegram update, they describe the decline as being in line with historical precedents that typically precede significant price bounces. This trend suggests that while the market appears bearish, the underlying moves could suggest a bullish scenario emerging.

Despite the downward market trend, QCP remains confident about the possibility of a recovery, driven by specific market mechanisms and upcoming financial products.

The options market, especially Ethereum (ETH), is seeing a bullish trend towards call options in the coming months, reflecting an confident sentiment among traders.

Additionally, QCP analysts have identified significant liquidation clusters for Bitcoin and Ethereum which, if triggered, could lead to aggressive low squeezes, potentially pushing prices higher.

QCP also proposed a strategic ETH trading strategy using KIKO (Knock-In, Knock-Out) options to leverage market volatility while also hedging against major downside risks.

This strategy highlights the firm’s expectations for positive developments in the ETH market, likely fueled by the approval of recent financial products such as the expected S-1 forms for Ethereum-based ETFs.

BTC plummets amid widespread liquidations

Bitcoin and Ethereum have seen notable declines over the past 24 hours, with prices falling to $58,057 and $3,134 respectively.

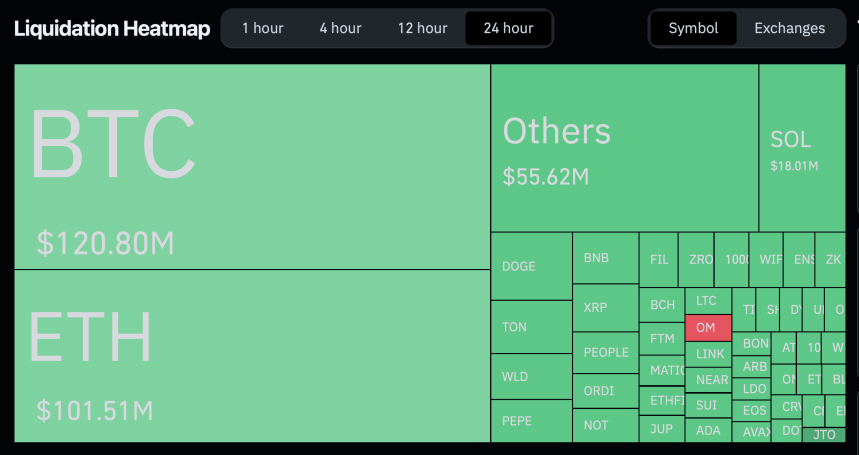

This crisis has significantly impacted the trading community and Coinglass reporting The total value of market liquidations was approximately $387.78 million, with a significant portion involving Bitcoin and Ethereum.

Liquidation patterns show a predominance of long positions, which indicates that many traders were expecting a price rally that did not materialize.

While the current market situation seems grim, deeper analysis by cryptocurrency experts like Crypto Patel suggests that this could be a harbinger of a bigger market move.

Patel’s analysis indicates that the price of bitcoin will fall to around $55,000, which may seem negative to others who remain confident and believe that the bottom has already been reached and the time for growth is coming.

#Bitcoin Analysis update 🚨

I hope you followed my analysis! $BTC hit a Break of Structure (BOS) and made a recent low, perfectly rejecting a Bearish OB. I am still bearish and see a potential drop to $55,000.

The recent OB is expected to be priced at $61k-62k, which will lead to a compact pump… https://t.co/LiMD6e4mdF photo:twitter.com/HiY5OWX6tt

— Crypto Patel (@CryptoPatel) July 4, 2024

Featured image created with DALL-E, chart from TradingView