Ethereum, mirroring the performance of Bitcoin and other leading altcoins, is back above $3,000, days after falling below $2,800. As the second most valuable coin recovers, injecting optimism among token holders and traders whose stocks have been hit, a close above $3,200 will be key in catalyzing demand.

Ethereum Rising: Will Bulls Push Above $3,200?

According to IntoTheBlock on July 10, if Ethereum edges above $3,200 level, this will be a huge development for traders. When this happens, around two million entities that traded ETH at this price will be in the money.

Therefore, if prices retest this level, those who went long could break even. Alternatively, other “diamond hands” expecting bigger gains on the horizon could double down and take advantage of the expected upside.

So far, there are signs of strength. However, while sellers are still in control, breaking through $3,300 will be key in the compact to medium term. The $3,300 level, looking at the ETHUSDT candlestick pattern on the daily chart, is a previous support but is now resistance.

A breakout, preferably on increasing volume, will likely serve as a basis for further gains, taking the coin towards the key liquidation level at $3,700 and then $3,900.

Conversely, if sellers take control, reversing recent gains and adjusting to losses from July 4 and 5, a drop below $2,800 would signal a continuation of the trend. Looking at the candlestick patterns, Ethereum will fall to novel multi-week lows on this event, falling as low as $2,500.

Eyes on Spot ETFs, Whales Gather as ETH Becomes Rare

Overall, analysts are bullish that Ethereum will sail higher. The expected launch of spot Ethereum ETFs in the coming days is a massive catalyst behind this bullish outlook.

Much like how Bitcoin ETFs opened the floodgates for institutional exposure to the world’s most valuable coin, the same inflow is likely to be seen in ETH. With institutional demand, proponents believe ETH will skyrocket, surpassing $4,100 and registering novel 2024 highs in the coming months.

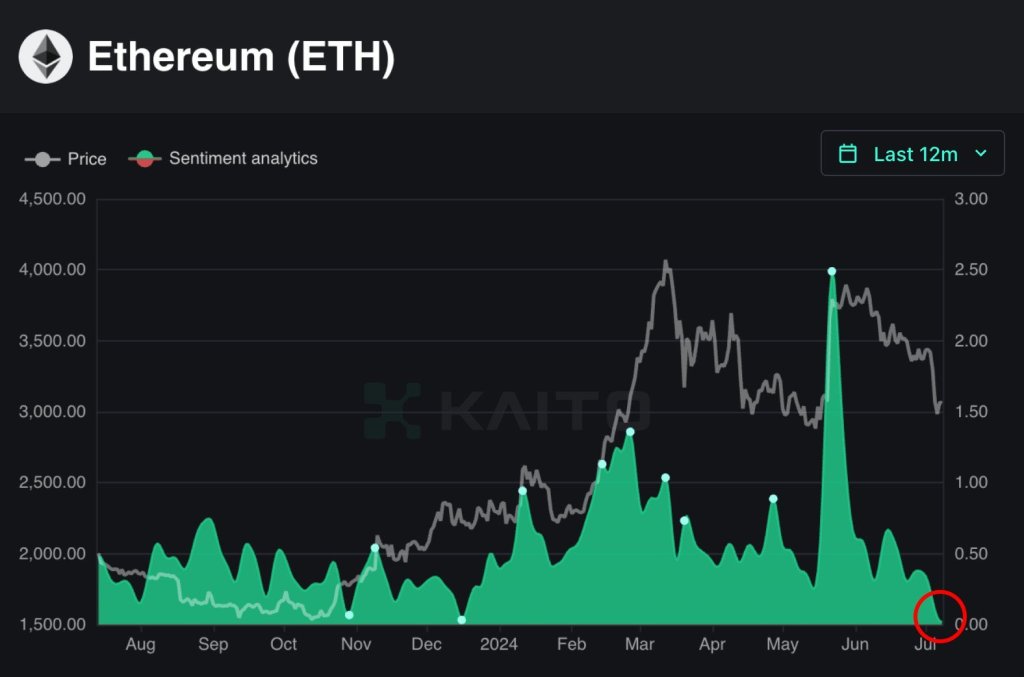

Interestingly, even the anticipation of a spot Ethereum ETF launch doesn’t seem to be changing traders’ sentiment. On-chain data reveals that the bullish bias is the lowest level in a yearindicating caution among ETH holders.

Meanwhile, as the data in the chain increases IllustratesETH outflows from exchanges have increased recently. All exchanges, including Binance and Coinbase, control 10.17% of ETH in circulation. Parallel data also to introduce that the next portion, representing 28% of all ETH in circulation, is already being staked.

Featured image from DALLE, chart from TradingView