This article is also available in Spanish.

In analysis shared on As Bitcoin’s (BTC.D) dominance continues to grow and altcoins struggle to keep pace, Astronomer provides a data-driven perspective challenging dominant narratives that suggest the era of altcoin seasons may be over.

The astronomer begins by acknowledging the difficulties that altcoin holders face in the current market environment. “Alts are still at low prices and BTC.D is raging and ETH (and altcoin) holders are struggling,” he notes.

He is observing a growing sense of disbelief among investors that Bitcoin’s dominance could decline again, casting doubt on the potential of another altcoin season. “You hear things like ‘BTC ETF changed everything’, ‘Boomers won’t buy altcoins and that’s why they won’t go up’, ‘BTC is at ATH and altcoins didn’t do anything.’ And all this is easy to say and understand because they fit perfectly into the current chart,” explains Astronomer.

However, he cautions against accepting these narratives at face value. “They give you a sense of comfort and a reason not to hold any alts, which is usually difficult in the accumulation stages, especially if the BTC chart ‘looks’ much better,” he adds.

To provide clarity, Astronomer provides their own definition of an altcoin season: “A true altcoin season is one in which liquidity from the most dominant asset (BTC) flows into other assets (ETH and altcoins). As a result, BTC.D falls and almost all altcoins go up.”

Arguments for the upcoming Altcoin season

The astronomer presents a number of facts to support his claim that the altcoin season is still on the horizon:

#1 Historical precedents

“The first fact: we had a season for large altcoins in every cycle (4-year rotation) like clockwork,” he claims. This pattern is apparent not only in historical charts, but also in the collective memory of those energetic in previous cycles. The astronomer cautions against adopting a “this time is different” attitude, which inherently puts investors at a disadvantage. “History rhymes/repeats,” he reminds readers.

#2 Bitcoin’s dominance chart follows a 4-year cycle

“The BTC.D chart follows its 4-year cycle,” notes Astronomer. He previously predicted that Bitcoin’s dominance would peak around 34 to 38 months into the cycle. “We are currently in the 33rd month of the four-year cycle, which means that in just a few months the situation will change,” he notes. According to the analyst, believing that Bitcoin’s dominance will continue to grow unchecked is essentially betting against established cyclical patterns.

#3 Great cryptocurrency rotation

“The ‘Grand Altcoin first rotation’ typically occurs once per cycle: around the fourth quarter of the third year of the cycle, and so far it is running like clockwork again,” states Astronomer. He explains that in previous cycles, some altcoins (a minority) performed well early on, driven by specific narratives, while the majority saw significant gains later, fueled by the liquidity flowing from Bitcoin.

He cites the 2018–2022 cycle as a perfect example. “In this cycle, in the first 3 years, LINK is a perfect example because it was one of the strongest top 100 altcoins and achieved 100x profit, while ETH (and all other BTC liquidity driven altcoins) achieved a paltry 3x,” he explains. In the last year of this cycle, the dynamics changed: “ETH gained 10x, and LINK only gained about 3x.”

#4 The overrated influence of ETFs on Bitcoin

Regarding the notion that the approval of the Bitcoin ETF has fundamentally changed market dynamics, Astronomer is skeptical. “The BTC ETF narrative of the alternative season being canceled is vastly overrated,” he argues. He points out that since their launch, total ETF flows have reached $40 billion, while centralized Bitcoin exchange (CEX) volumes average $20 billion per day. “ETF flows are negligible and that’s why I’ve never heard myself talking about them because I like to filter out the noise,” he claims.

#5 Favorable monetary policy is coming

The astronomer also highlights macroeconomic factors that could benefit altcoins. “Interest rates are falling, the money supply in the US is increasing dramatically (now China is also following suit). The only thing we are waiting for is QE, which is usually a natural consequence of M2 growth (with a delay),” he explains. Historically, such monetary conditions have favored the appreciation of altcoins. “A change in monetary policy in our favor usually also means a good situation for altcoins,” he notes.

#6 Bitcoin’s all-time high is an arbitrary indicator

It challenges the notion that Bitcoin reaching an all-time high (ATH) without a concurrent altcoin season represents a indefinite decoupling. “BTC to ATH is an arbitrary measure of when the alt season begins and the fact that it has reached ATH but the altcoin season has not yet started does not, in my opinion, justify calling it canceled,” argues Astronomer. He emphasizes that timing and cyclical patterns are more critical factors than price milestones.

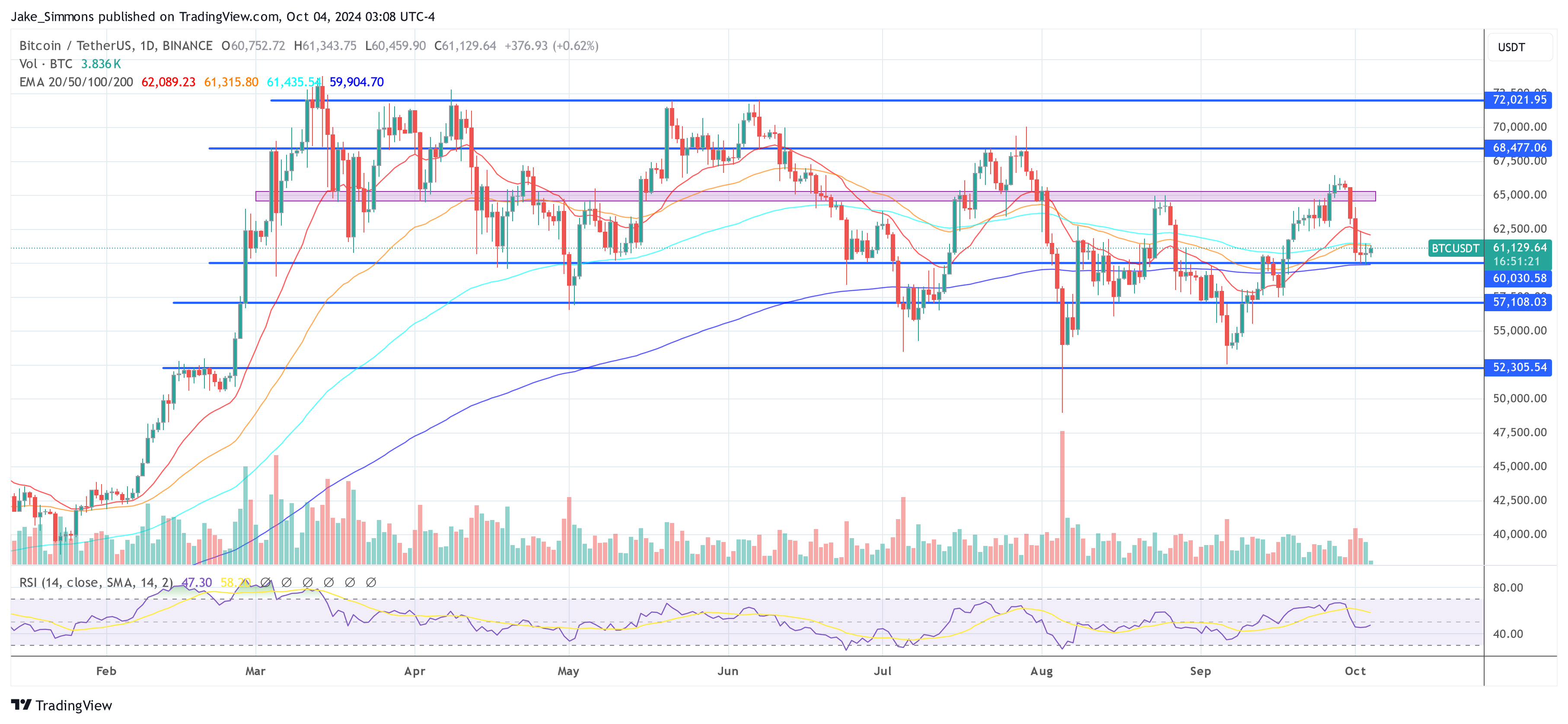

At the time of publication, Bitcoin was trading at $61,129.

Featured image created with DALL.E, chart from TradingView.com