The cryptocurrency market has recently shown clear divergences in the behavior of its two leading assets, Bitcoin and Ethereum. While Bitcoin appears to be entering a phase of relative stability, Ethereum’s journey looks like this: contrasting image continuing uncertainty, especially in the options market.

This divergence is underlined by the continued high level of implied volatility associated with Ethereum options, signaling investors’ cautious approach to future price movements.

Ethereum’s Persistent Volatility: A Comparative Analysis

Implied volatility (IV) serves as a key indicator in the options market, providing insight into the expected fluctuations in asset prices over a specific period. It reflects market temperature and measures the intensity of potential price movements that investors expect.

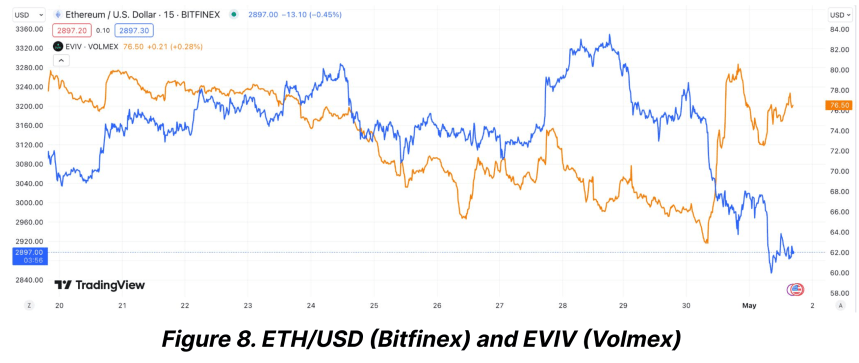

Recent analysis suggests that while Bitcoin’s implied volatility has calmed down significantly following the halving, Ethereum’s volatility has not followed suit. While Bitcoin’s IV has fallen to its lowest level in months, indicating a calming market, Ethereum’s IV remains stubbornly high.

Unlike the calming waves in the Bitcoin market, Ethereum is struggling with increased volatility. According to data from the Bitfinex Alpha Report, Bitcoin’s volatility rate has plummeted from 72% at the time of the last halving to around 55%.

Ethereum, on the other hand, saw a more modest reduction in its volatility rate, dropping from 76% to 65% over the same period. This continued volatility in the Ethereum market is primarily driven by uncertainty surrounding significant upcoming regulatory decisions and broader market implications.

The Ethereum market is particularly turbulent in anticipation of the U.S. Securities and Exchange Commission’s (SEC) upcoming decision on two spot Ethereum ETFs, scheduled for behind schedule May 2024.

This upcoming regulatory milestone is considered a critical event that could catalyze significant market movement or exacerbate current volatility.

The Bitfinex Alpha report highlights that regulatory uncertainty is a major factor behind Ethereum’s less significant decline in volatility risk premium (VRP) compared to Bitcoin.

ETH and BTC are showing signs of recovery amid volatility

Ethereum and Bitcoin have shown signs of recovery over the past week in terms of trading performance. Bitcoin rose 4.1%, while Ethereum saw a more modest gain of 2.4%.

However, the last 24 hours have been less favorable for Ethereum, with a slight decline of 0.7%, highlighting the continued volatility and caution of investors.

Moreover, Ethereum network dynamics also reflect reduced activity with a significant drop in ETH burn rate attributed to reduced transaction fees.

This technical aspect further adds to the cautious narrative surrounding the Ethereum market, poised on the brink of potentially significant changes depending on external regulatory actions.

Still, analysts like Ashcrypto suggest that the current volatility could set the stage for a sturdy rebound in the third quarter of the year. Based on historical patterns, Ethereum’s speculative forecast potentially reaches $4,000, provided market conditions remain favorable.

Featured image from Unsplash, chart from TradingView